How does owning or renting relate to household independence across the life course and has this relationship changed? For this analysis of the US, we use Census ACS 5-year data from 2010-2022 to investigate how tenure has shifted across different age groups in the United States.

Tenure data trends

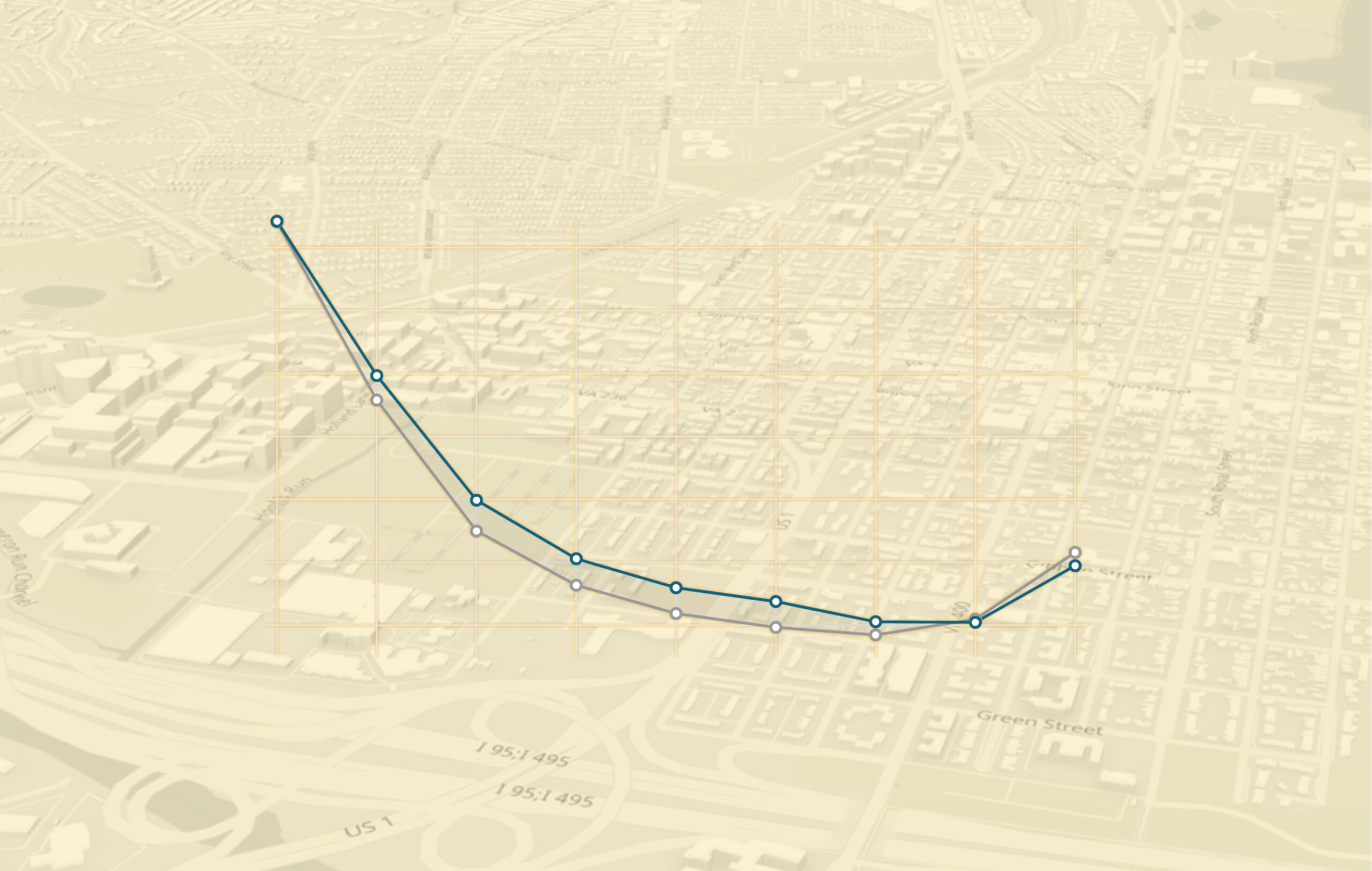

The data indicates a clear trajectory where young adults primarily rent and gradually transition to homeownership as they age, and then a partial return to renting in old age. However, at the margins, we can see some variation over time.

- Less than 24: The vast majority of this group rents, with over 84% renting consistently through the years.

- Ages 24-34: More than half of this segment rents, and the number of households renting went up 7% in the last 12 years, with more than 60% renting in 2022.

- Ages 35-44: Homeownership increases in this segment, with approximately 40% renting and 5% more renting households than in 2010.

- Ages 45-64: Homeownership increases through this segment, with rental rates below 25%, but an increase of 4% of households renting since 2010.

- Ages 65-84: The highest homeownership rate with only 20% renting and limited change since 2010.

- Ages 85 and older: Renting increases slightly to 29.5%. There are fewer renters than in 2010, with 2% more homeowners, which can be attributed to homeowners aging in place.

Younger households are much more likely to rent

Understanding tenure dynamics is important for policymakers and planners. Across the board, our clients are concerned about losing young people and losing workforce. Given the strong rates of renting households under age 34, including Generation Z and younger Millennials, it is worth considering if a community is providing sufficient rental opportunities. This age cohort is more mobile at the start of their careers, often does not have the savings required to become homeowners, and may rent due to lifestyle preferences.

More middle-age renters and market frustration

As homeownership becomes less attainable, the rental period is extending to middle age. Higher rates of rental among middle-aged Americans, including older Millennials and Generation X, represent a potential frustration with the market. While most of this segment would likely prefer homeownership, rental housing does provide the ability for individuals to maintain an independent household, rather than live with roommates or with extended family, and thus fills an important role in the market.

The increasing importance of rental housing

Rental housing provides an important role in the housing market for the young and mobile, and that role is more important than ever as the aspiration of homeownership has been delayed for middle-aged Americans due to restricted supply, the lock-in effect of current owners, and high interest rates. Policymakers should take these points into account when considering how to meet goals, such as a high-quality and independent life for residents and economic development with sufficient opportunities for workforce housing and retention.

Thank you to Jens von Bergmann for writing about this topic in Canada.