Determining how much a household can afford to pay for housing depends on numerous factors, from mortgage rates to down payments to property tax rates. It isn’t as simple as income vs. house price. With the right variables accounted for, planners can more accurately calculate housing affordability by income level.

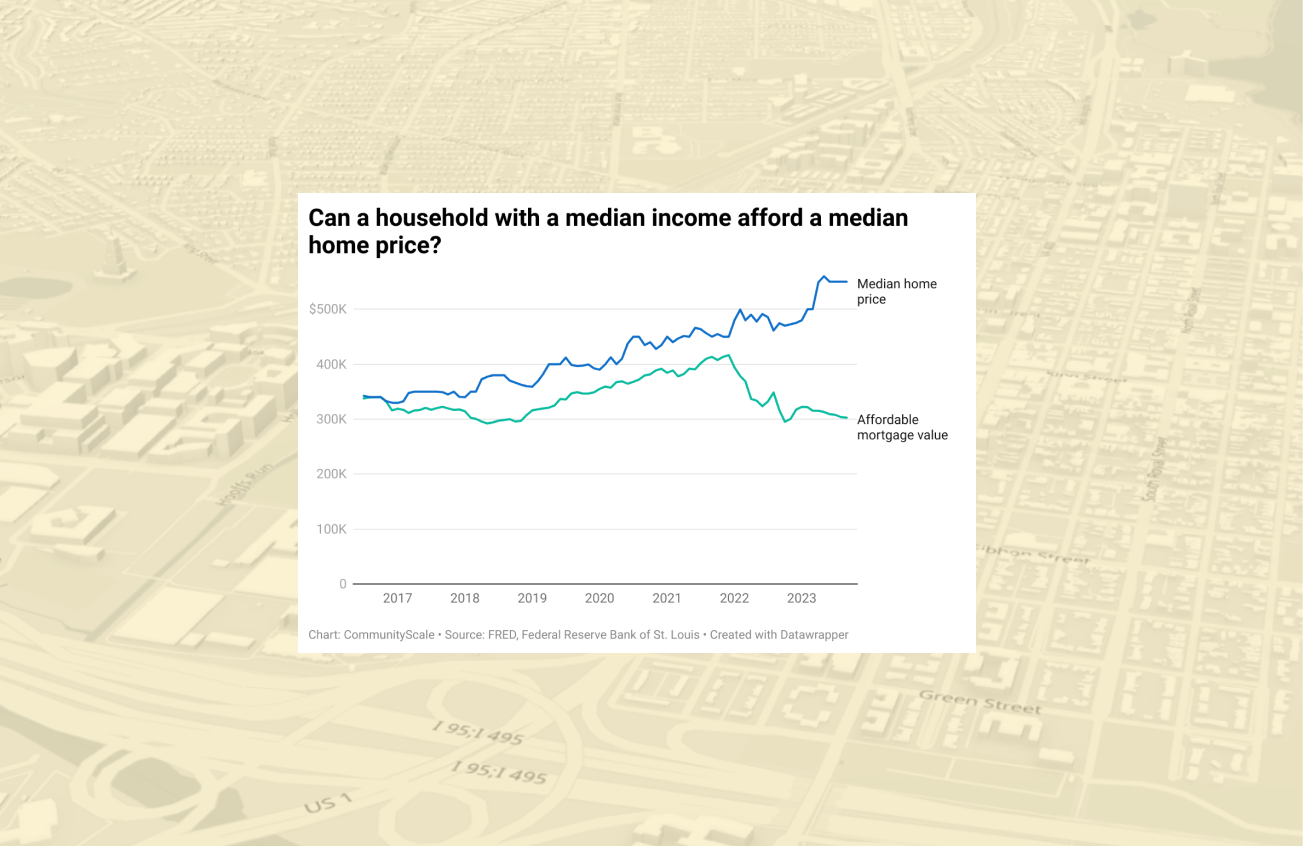

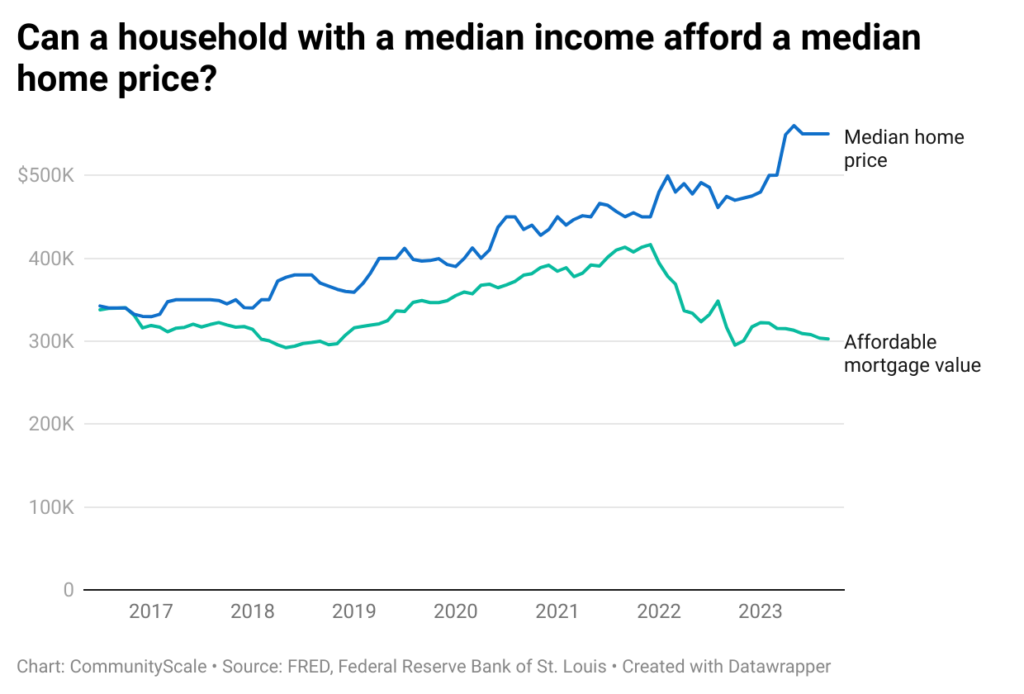

Conventionally, housing affordability is understood in terms of income vs house price: can an annual household income of X afford to purchase a property priced Y without committing more than 30% of its total income to the unit and thus incurring cost burden? In practice, the math is more complicated – and involves variables that change over time based on external market conditions.

The following variables influence housing affordability in addition to income and sale price:

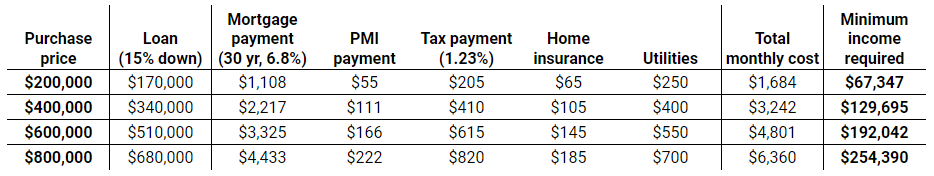

- Loan term: 90% of mortgages in the US are 30-year term loans. However, some households opt for shorter terms. For example, 15-year loans may offer lower rates but require higher monthly principal payments.

- Mortgage interest rate: Mortgage rates are a primary driver of affordability. Lower rates amplify a household’s buying power while higher rates can dramatically reduce it.

- Down payment: While a 20% down payment is often considered standard, most households pay less. This resource lists typical down payment rates by state. The higher the down payment, the lower the monthly principal payments on the loan.

- 0.5% PMI: Virtually all lenders require private mortgage insurance (PMI) when a down payment is less than 20% of the purchase price. Rates range widely due to a variety of factors but 0.5% approximates a typical rate.

- Property tax rate: Property tax obligations reduce the amount of household income available for mortgage payments.

- Home insurance: Banks require homeowner insurance as part of the financing process.

- Utilities: Homeowner costs include the basic utilities required to keep the property heated and operational.

Here are four hypothetical examples based on typical interest rates and homeowner costs in Fall River, MA. Each starts with a given purchase price, calculates likely monthly costs, and determines the minimum household income required to afford the property without becoming cost burdened.

Planners should account for all of these variables when calculating how much house a typical household with a certain income can afford. Because some of these variables change over time – especially mortgage rates – these variables can also help planners gauge whether market conditions are more or less favorable for home buyers – particularly those reliant on financing to complete a purchase.

Check out this post to learn more about the relationship between income and housing prices.