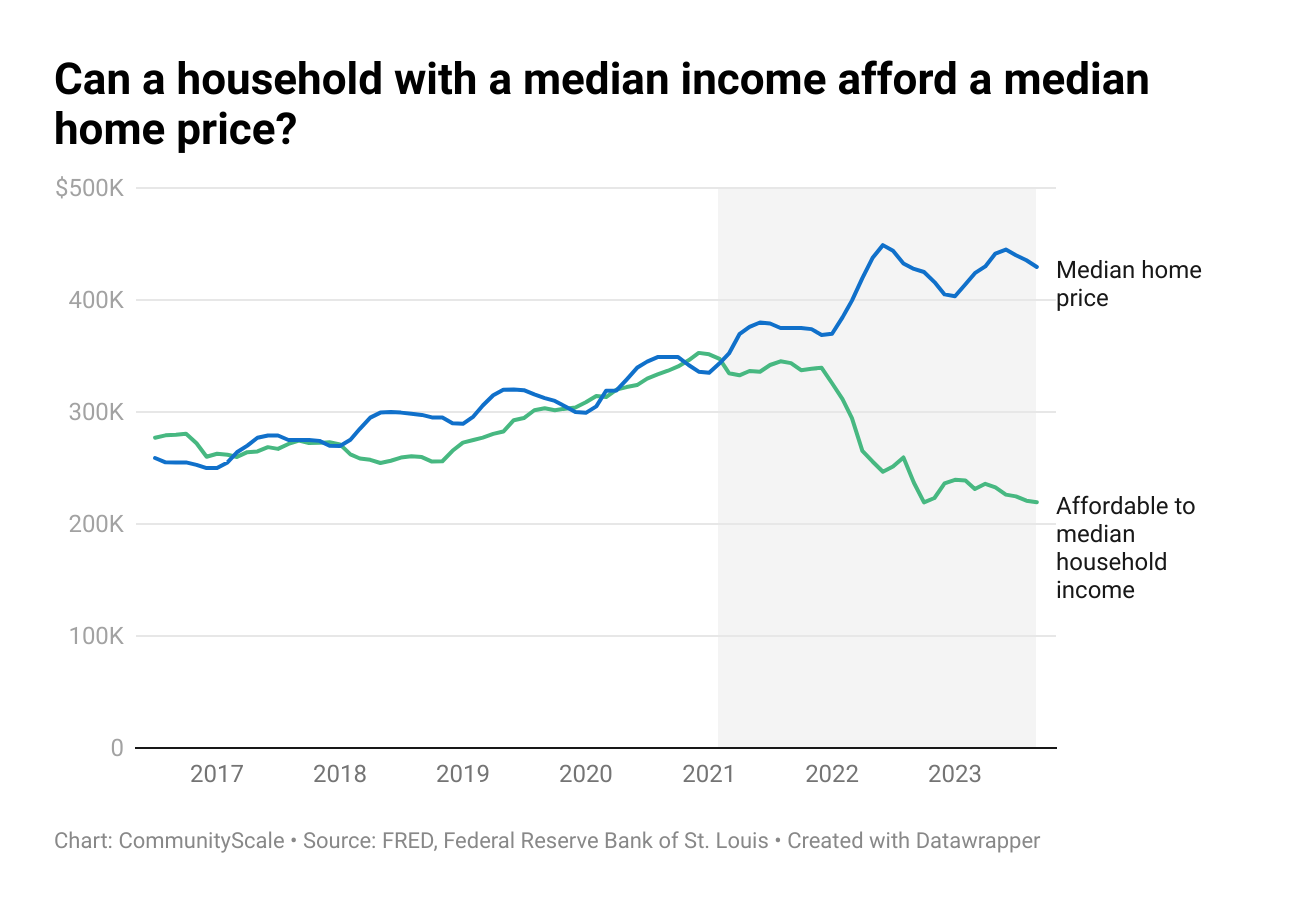

For the first time in years, the median household income is not enough to afford a median-priced home – not even close!

For most of the past decade, home prices and household incomes have generally tracked together, with incomes rising at about the same pace as home prices. However, since the beginning of 2021, these indicators started diverging to the point that, by late 2023, the median home price was well out of reach for median income households.

As the chart below illustrates, by September 2023 the median home in the US costs about twice what a median income household can afford:

What is driving this trend? The key variable seems to be interest rates. Since the monthly payment on a mortgage is driven in large part by the interest rate at the time of closing, lower rates can help households afford higher-priced homes and/or insulate households from rising prices.

As home prices rose through the first years of the pandemic, falling interest rates helped mitigate cost impacts by by enabling households to afford the more expensive homes without significant increases to their financing costs.

However, starting around the beginning of 2022, interest rates began to climb again, effectively reducing households' purchasing power in the housing market. To compound the situation, home prices continued rising and even spiked at times during 2022 and 2023. The combination of mounting financing costs and ongoing price increases has created an affordability crisis for homebuyers across the country. By October 2023, the median home price in the US was twice what a median household income could afford.

What can we do about it? There is no easy answer to this question. One underlying driver of these trends is a chronic undersupply of new housing production across affordability levels and building types. Especially given unprecedented material and construction costs, building our way out of this crisis is not a silver bullet option. Instead, communities, stakeholders, and agencies at local, regional, state, and federal levels need to come together around a range of responses that reflect an "all of the above" approach to policies and programs aimed at many parts of the challenge simultaneously.

CommunityScale was built to play an important role in this conversation by helping communities understand and navigate this affordability crisis as it impacts their residents and stakeholders. We invite you to reach out and join the discussion!